How to Double Your Money Risk Free

Doubling your money is actually pretty easy. It's called multiplication.

2 x 2 = 4 $

4 x 2 = 8 $

8 x 2 = 16 $

16 x 2 = 32 $

32 x 2 = 64 $

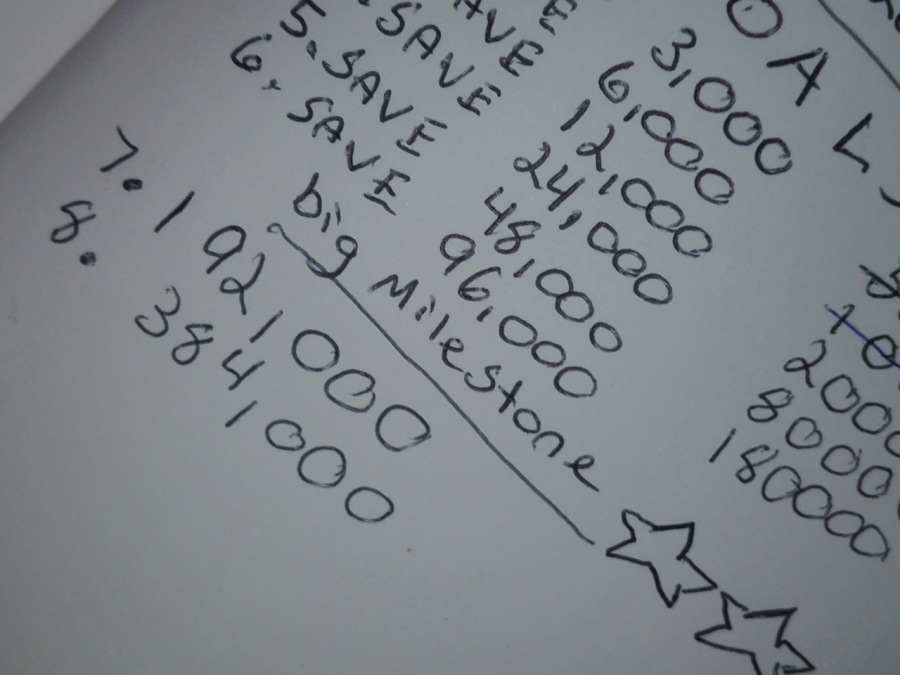

If you want to double your money with zero risk, you have to save. Saving is one the best ways to utilize your income. A lot of financial gurus will tell you that saving is a fruitless effort and the only way to make money is to spend money. Though we agree investments are something everyone should look into at some point on their journey to becoming financially secure. We believe saving is mandatory and therefore a priority over investing.

Unfortunately, most people don't save and it's not because they are poor. It's because they are consumers. Until you have a good chunk of change in your savings account, you might want to postpone shopping sprees, eating out with friends, fancy drinks, road trips and getting you hair done.

Which leads me to some devastating news for the ladies, women are terrible saviors compared to men and we think it's because they have too many shoes and makeup is really expensive. I told my mother I usually wore my shoes until they started talking, which took about 6 months to a year. She told me that was ridiculous and I needed more shoes, but doesn't it make sense to hold off on buying new shows until I actually need them.

Currently, I have three pairs of shoes in my closet. Boots, sneakers and dress shoes with a slight heel for work. However my aunt and sisters are guilty of owning over 30 pairs of shoes a piece. Ladies, is hoarding footwear really more important than financial security?

However, though statistically women save less money than men. American's as a country is pretty bad at saving their money and living dangerously close to the edge.

"Approximately 62% of Americans have less than $1,000 in their savings accounts and 21% don’t even have a savings account, according to a new survey of more than 5,000 adults conducted this month by Google Consumer Survey for personal finance website GOBankingRates.com. “It’s worrisome that such a large percentage of Americans have so little set aside in a savings account,” says Cameron Huddleston, a personal finance analyst for the site.

Market Watch

A savings account is the beginning of financial security. The more money you have in savings, the safer you are. Cash is King. I have never seen a pair of shoes at a pawn shop. Shoes are just not good things to own in bulk. Jewelry is another story.

Now some people are lucky and they can depend on their friends and family in times of need. Some people are not so lucky, which means you can break both your legs falling down a flight of stairs and be completely screwed. For people who have nobody to depend on financially, even in the worse of times, we recommend you have 6 months worth of living expenses in the bank before you begin investing because investing does not guarantee an increase in money. Investing could mean a loss of money. Consider this, there are probably far more investment scams out there than sure things.

Before you make excuses for why you can't save, consider it paying a bill to yourself. Put money in your savings account before you do anything else. Also remember to set a budget to see where your money is going.

For instance, on an income of $3,000 per month, we might budget as follows:

Housing/utilities: $1,000

Student loans: $300

Food: $500

Internet: $70

Gasoline: $150

Savings: $500

Misc.: $200

Luxuries: $280

For high achievers, the method for quadrupling your money follows:

2 x 2= 4

4 x 4 = 16

16 x 16 = 256

Happy Savings

""

来自Lyon Brave的文章

查看博客

Introduction: · In the world of marketing, there are individuals who possess an extraordinary blend ...

In this life we are all doing our best to get ahead, but our best is often not good enough to get ou ...

First of all it's Christmas time and holiday cheer is spreading. · When the new year creeps in and t ...

你可能对这些工作感兴趣

-

Director of Finance

发现在: Talent CN S2 - 3天前

Hyatt Corporation Qingdao, 中国 全职Director of Finance - Hyatt Regency Zhuhai Airport · Hyatt Regency Hyatt Regency Zhuhai Airport CN ZhuhaiAdministrativeDirectorFull-timeReq ID: ZHU000477Local Summary · You will be responsible for the efficient running of the division in line with Hyatt Hotels Corporation's C ...

-

资深3d角色模型设计师

发现在: Talent CN S2 - 2天前

Tencent Shenzhen, 中国资深3D角色模型设计师 深圳 分享 分享岗位 · 方式1:复制岗位链接 · 方式2:分享岗位海报 · 手机扫描二维码分享 · 收藏 IEG 点击了解更多BG信息 设计 五年以上工作经验 更新于年04月02日 岗位职责 1.根据项目需求制作项目角色相关资产;2.资源导入引擎进行调试材质及贴图绘制,并在游戏里验收最终效果;3.与原画设计,动作设计协作配合,完成角色的全流程开发,建立维护3D角色的生产管线;4.负责CG中的修型审核检修,并把控风险;5.维护角色资产在lookdev中的表现,提出相应的渲染、材质、灯光相关需求。 · 岗位要求 1. ...

-

Solutions Architect

发现在: Talent CN S2 - 1周前

Amazon Information Service (Beijing) Co., Ltd. (Shanghai Branch) Shanghai, 中国 全职Amazon Web Services, an Company, has been the world's leading cloud provider for more than 17 years with the most mature, comprehensive, and broadly adopted cloud platform. We have over 200 fully featured cloud services, managed from 99 availability zones within 31 geographic re ...

Co., Ltd. (Shanghai Branch)&v=024)

评论